The world’s largest financial assets manager, BlackRock, is telling the investment community in no uncertain terms that the “compelling” risks posed by climate change are forcing “a reassessment of core assumptions of modern finance.”

In an open letter to chief executive officers, BlackRock Chairman and CEO Larry Fink says that, “sooner than most anticipate … there will be a significant reallocation of capital” as a result of climate change.

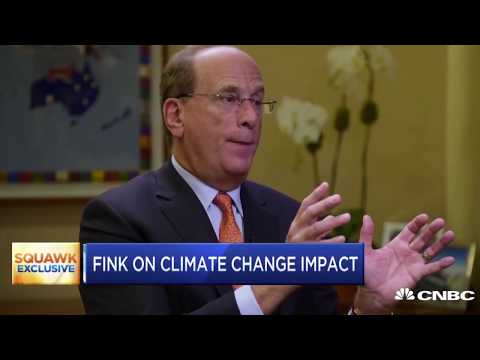

Compared to “all the different crises” he has dealt with throughout his investment career, “It’s very clear to me that the physical changes we may see with climate change are more permanent. We don’t have a Federal Reserve to stabilize the world,” he cautions in this original video produced for Yale Climate Connections. “This is bigger, it requires more planning, it requires more public/private connections to get together to solve these problems.”

“Because capital markets pull future risk forward,” Fink wrote in his open letter, “we will see changes in capital allocation more quickly than we see changes to the climate itself.”

In a growing crescendo of top corporate and investment managers warning of risks posed by climate change, Fisk expresses optimism that the problems “could be solved, but the actions need to begin now.”

Fisk is no lone wolf in the investment community publicly cautioning about climate change risks.

- Mark Carney, governor of the Bank of England, cautions that the “slow-burning crisis is making it more difficult to act” and warns that a mortgage market crisis is “just coming into focus.” He points to current worldwide storm damages of about $50 billion a year dwarfing the 1980’s damages of about $10 billion annually.

- CNBC financial analyst Jim Cramer says young investors and millennials, in considering their own investment choices, now routinely first ask, “Well, is the company despoiling the environment?” Cramer reports on Microsoft CEO Satya Nadella’s “moon-shot promise” to be carbon-negative, not just carbon-neutral, by 2030: The company is “putting the hammer” on itself and on its suppliers in an effort to undo four decades of greenhouse gas emissions. “I think this is real,” Cramer says of the Microsoft effort. “This isn’t greenwash.”

With projections of 10 electric vehicle models – “full battery electrics” – being put on the market by auto companies this year, an industry analyst says he foresees a coming “tsunami” of EVs, eventually totaling more than 100 electric vehicles. And Catherine Wood, CEO of Ark Invest, says the falling costs of batteries will drive prices of EVs to lower than costs for “like-to-like” fossil fuel-powered vehicles over the next 18 to 24 months. She says relative prices for EVs going forward “will continue to fall.”

The video illustrates how the protests and concerns about climate change impacts on investors have moved well beyond stakeholder protests and petitions at corporate annual meetings and increasingly are coming from top investment and corporate officials themselves often running such meetings.